How to position your investments in retirement, navigate the tax system, choose when and how to draw down from your portfolio

There are 7 distinct modules with individual video lessons, guiding you step-by-step along the way.

Retirement Planning is not just about having comprehensive financial information. You’ll learn exactly how to put it into action.

There are 7 distinct modules with individual video lessons, guiding you step-by-step along the way. Worksheets, quick guides, reviews and checklists will help you stay organised and move forward quickly.

Connect with other students, ask questions, participate in the monthly live sessions, give and receive encouragement.

This is your opportunity to ask the questions that are important to you.

This module is the setup.

Essentially, it is outlining the key factors in approaching retirement, taking in income sources, expenditure, early retirement, preparing your various pensions and investments for the journey, and planning the first few years.

Investing in retirement is (or should be) different from the accumulation phase. This module is split into two parts – firstly a deep-dive on how investing works generally, lifted from the Build Wealth phase of the Academy.

Then we take that high-level knowledge and apply it to the unique timeline of retirement, building what I call a Cashflow Ladder which gives your money the best chance of outliving you and keeping pace with inflation.

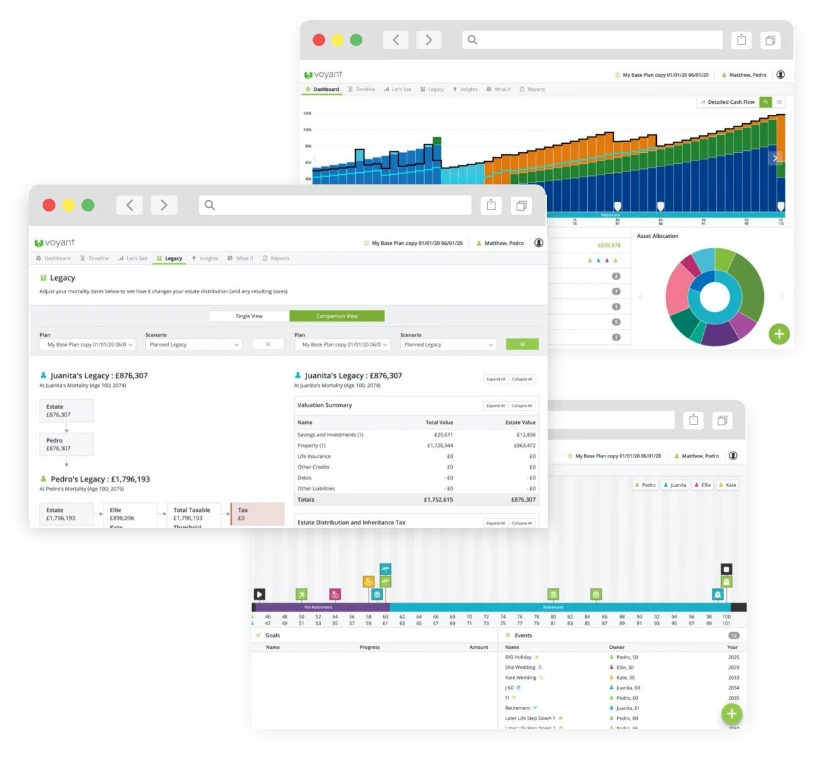

I think this is my favourite module because it involves planning your retirement using the incredible Voyant Go planning app which is included free for a year as part of your membership.

The module walks you through how to use the app, and how to plan things like income withdrawals, as well as determine things like the investment return you will need to make your money last the course. It’s powerful, exciting stuff!

Here we go into the detail of making good decisions in retirement, for example drawing from pensions or ISAs? Or retiring early and bridging the gap before state or occupational pensions kick in.

There are as many different versions of the retirement journey as there are people retiring, so this module is designed to give you the tools to finesse your particular journey.

For many of us, retirement is a 30- or even a 40- year journey and it’s important to keep a handle on the various moving parts of your finances throughout.

This module looks not only at reviewing your investments, but also your changing cashflow needs throughout retirement.

If you’ve listened to the MeMo podcast at all, you’ll know that I emphasise the importance of good financial behaviour.

We can so easily derail our financial progress by making bad decisions. It’s important to know how this can work, so we can do our best not to travel that road.

There’s no getting away from the fact that retirement is the last act in the stage show of our lives.

And that means that inevitably our minds will start to turn towards the end game, giving away assets, wills and power of attorney planning and all that stuff which, while it isn’t exactly fun, is extremely important.

There are lots of decisions to make, risks to manage, and complex rules to navigate. In this convenient and good value package, Pete does a great job of demystifying retirement planning.

He's got an engaging style, with a knack for focusing on the big issues and making the complex seem simple. It's a great resource if you're managing your own retirement finances.

And it's a great resource if you want to build your knowledge so you can choose the right IFA, who knows what they're talking about in this complex and specialist area of advice.

Great job Pete!

Voyant Go is the most powerful financial planning software in the world, yet easy for non-financial professionals to use.

There are videos in Retirement Planning to walk you through building your first financial plan in Voyant Go.

The best part is that your first year subscription to the app is included

in your Academy membership.

(To retain access after the first year, there is an annual fee to pay. You

will keep your access to the Retirement Planning curriculum indefinitely regardless of whether or not you continue your Voyant Go subscription.)

This is easily one of the best bonuses of Meaningful Academy - Retirement Planning which will naturally continue to expand and become better.

Joining the group is reserved only for students of this course. Connect with other students, ask questions, participate in the monthly live sessions, give and receive encouragement along the way.

Apart from the main video lessons in Retirement Planning, we have included additional materials to help you move forward confidently, organise your finance and keep track of what’s going on.

Included are workbooks, cheatsheets, quick guides, review sheets, planning tools, questions to ask your providers and much more. All these can be printed and filled by hand or used digitally.

Each month, I (Pete Matthew) host a private Live Q&A Session in the Facebook group mentioned above. This is your opportunity to ask a specific question and get the answer you need to move forward. So, if you feel stuck or there’s something that we can address, I’d be happy to do so.

Otherwise, you can always reach me by email if it’s a sensitive question.

I want you to be sure that this investment is the right one for you and that it will get you on track to achieve your financial goals. If, for any reason, you don’t like Retirement Planning, you can get a full refund anytime within 30 days after your purchase. If you have any issues, just get in touch we’ll give you a swift refund.

Get the financial education you need to master the basics, build wealth, and plan for a comfortable retirement with Meaningful Money Academy.